Have you ever wondered how new bitcoins are created and transactions on the bitcoin network are verified? It’s all thanks to bitcoin mining!

In a nutshell, bitcoin mining is the process of using powerful computers to solve complex mathematical problems and process transactions on the bitcoin network.

Miners are rewarded with a certain number of bitcoins for their efforts, which helps to ensure the security and integrity of the network.

In this article, we’ll dive into the details of how bitcoin mining works and why it’s so important for the functioning of the bitcoin network.

What is Bitcoin Mining?

Bitcoin mining is the process of verifying and processing transactions on the bitcoin network, in which miners use powerful computers to solve complex mathematical problems.

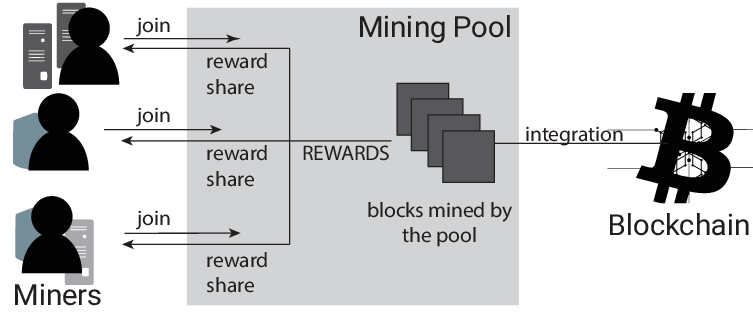

In return, they are rewarded with a certain number of bitcoins. Miners join pools and use specialized software to participate in the process.

When a new block of transactions is added to the blockchain, the miner who successfully processes it is rewarded. As the network grows and the problems become more complex, miners need more powerful computers and more electricity to stay competitive.

Bitcoin mining is crucial for the security and maintenance of the network, but it is also resource-intensive and has been criticized for its high energy consumption.

How Does it Work?

Here are the main steps involved in the process of bitcoin mining:

1. Transaction Validation

When a new transaction is made on the bitcoin network, it is broadcast to a network of computers called nodes. These nodes validate the transaction, ensuring that the person making the transaction has the necessary funds and that the transaction follows all the rules of the bitcoin network.

2. Mempool

Once a transaction has been validated, it is added to a pool of unverified transactions called the mempool.

3. Proof of Work

Miners then compete to process transactions from the mempool by solving a complex mathematical problem known as a proof of work. This problem is designed to be difficult to solve, but easy to verify once it has been solved.

4. Block Creation

The miner who solves the proof of work first gets to add the next block of transactions to the blockchain and is rewarded with a certain number of bitcoins.

5. Block Verification

Other miners on the network then verify the block and, if it is valid, add it to their own copy of the blockchain.

6. Reward

The miner who added the block to the blockchain is rewarded with a certain number of bitcoins for their work. This process is known as mining, and it helps to ensure the security and integrity of the bitcoin network.

The Challenges of Bitcoin Mining

If you want to get your hands on some bitcoins, you’ve got a few options. You can buy them on an exchange, accept them as payment for goods or services you sell, or try your luck at mining them.

Of these choices, mining is probably the most exciting. It’s like a treasure hunt, where you use your computer to solve math problems and verify transactions.

The only downside is that it can be pretty demanding – bitcoin mining requires a ton of computing power. But if you’re up for the challenge, it can be a fun and rewarding way to acquire some bitcoins.

What Would The Miners Get?

Miners validate and process transactions on the bitcoin network and solve complicated mathematical puzzles because they are incentivized with rewards.

These rewards include earning new bitcoins and a percentage of the transaction fees for the transactions they add to a block. Without these incentives, miners would not incur the high infrastructure and energy costs involved in the mining and validation process.

Bitcoin Miner Payment= Block Reward + Transaction Fees

Currently, Bitcoin miners are given 6.25 Bitcoins for every block they add to the Bitcoin blockchain network. When Bitcoin was first introduced in 2009, miners received 50 Bitcoins for each block.

This reward was gradually reduced to 25 Bitcoins in 2012, 12.5 Bitcoins in 2016, and 6.25 Bitcoins in 2020. This process is called Bitcoin halving and happens every 210,000 blocks, or about every four years. During halving, the block rewards are cut in half.

Bitcoin Mining: Things Your Should Know!

1. The First Blockchain

The first block of the bitcoin blockchain, known as the “genesis block,” was mined on January 3, 2009 by the pseudonymous creator of bitcoin, Satoshi Nakamoto.

2. The High Electricity Consumption

The process of mining bitcoins requires a lot of computing power and electricity. In fact, it is estimated that the total energy consumption of bitcoin mining is equivalent to the annual energy consumption of a small country like Argentina or the Netherlands.

3. Be Out of The Box

Some people have turned to creative methods to mine bitcoins, such as using the heat generated by bitcoin mining servers to warm their homes or even using old smartphones to mine bitcoins.

4. Collaborative Space

The process of mining bitcoins is competitive, and miners often join forces in mining pools to increase their chances of finding a block and earning a reward.

5. Bitcoin Halving

The reward for mining a block of transactions on the bitcoin network is currently 6.25 bitcoins, but this reward is halved every 210,000 blocks, or approximately every four years. This process is known as bitcoin halving.

Conclusion

So, what have we catched about bitcoin mining? It’s a vital part of how the bitcoin network works, helping to verify transactions and keep the blockchain secure.

It can be tough going, requiring lots of computing power and energy, but it can also be a really cool and rewarding way to get your hands on some bitcoins.

You’ve got a few options when it comes to acquiring bitcoins – you can buy them on an exchange, accept them as payment, or try mining them yourself.

Each method has its pros and cons, so you’ll want to weigh them carefully and choose the one that makes the most sense for you.

No matter what you do, make sure you educate yourself thoroughly about the risks and potential rewards of any bitcoin-related activity. That way, you’ll be in the best position to make informed decisions and potentially come out on top.